Best Payment Gateways for e-commerce store in 2024

Payment Gateway is one of the most essential, if not the most essential component of any e-commerce website. Choosing a right or wrong payment gateway can have a drastic effect on your business, sales and revenue. While the deciding the right provider can be quite complex depending on type, nature of your business, country of operation, and scale of your operation & volume of transactions. But in this article our attempt is to give you a broad overview and a thorough information that will definitively help you choosing the right payment gateway for your e-commerce website.

We have personally used these payment gateways in our past e-commerce projects and have experience of integrating them with most e-commerce platform out there.

Now before beginning with the blog, I would like to clarify a common confusion in the mind of many store owners and non-technical users between the term “payment gateway, and payment method.”

What is the Difference Between Payment Gateway and Payment Method

A payment gateway is a service that allows businesses to accept online payments. It acts as an intermediary between the customers and the e-commerce store owners. It allows processing the payment and transferring the funds to the merchant’s account. A payment method is the way that a shopper pays for goods or services online. This could be a credit card, debit card, digital wallet, or another payment method. Generally, most modern payment gateways provide multiple payment methods to make payment, the more options you offer to your customers the better the chances of conversion. So, the options payment options customers see on the checkout page is a payment method, and the service provider like PayPal or Stripe is the one who is providing the infrastructure to process the payment an e-commerce website. Please remember the difference between these terms in order to avoid the confusion further down the blog.

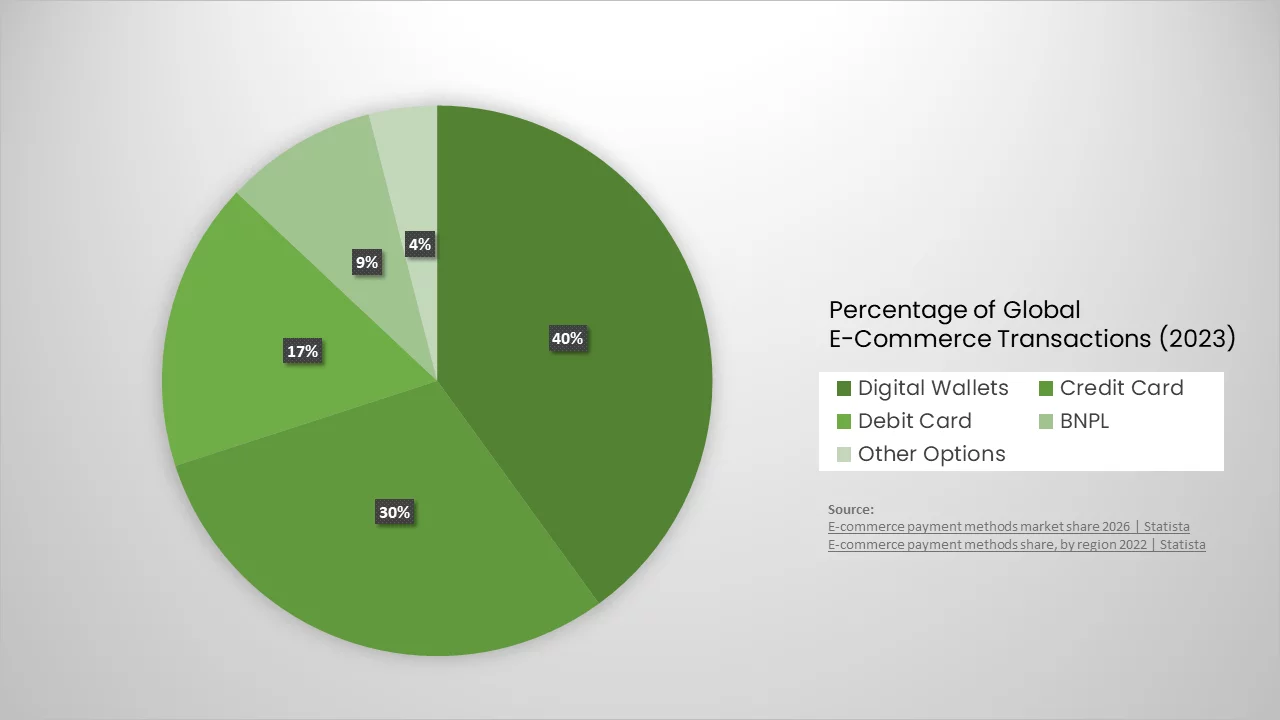

Most Popular payment methods in 2023

Payment methods or payment options is someting your end-customer cares about, so you might ask which payment methods or payment gateway I should have in my e-commerce website?

Well here is your answer…

Digital Wallets

Digital Wallets are the most popular payment methods among the online customers with more 40% of share in transaction in the year 2023. Digital wallets have become increasingly popular in recent years due to their convenience and security. They allow users to store their payment information in a secure digital wallet, which can then be used to make purchases online or in-store with a single tap or click. Some popular digital wallets include PayPal, Apple Pay, Google Pay, and Amazon Pay.

Credit cards

Credit cards are still a very popular payment method for eCommerce purchases globally with over 30% share, but their usage is declining. This is likely due to the rise of digital wallets and other innovative and more flexible payment options like BNPLs. Though it will still likely stay one of the most popular payment options because of the sheer number of users and convenience it offers.

Debit cards

They are another popular payment method for eCommerce purchases, especially in the emerging and developing countries. They are similar to credit cards, but they use the funds in a user’s bank account instead of a line of credit. They have replaced cash transactions in many emerging markets. According to the Statista they constitute 18% – 20% e-commerce translation in 2023.

Buy now, pay later (BNPL)

BNPLs is the newest and the most exciting payment option available in 2023. It is quickly becoming one of the most popular payment options in recent times, they are particularly popular among younger consumers, and very suitable for businesses selling high-value product to end-customers like jewelry, luxury fashion, or consumer durables. BNPL services allow customers to purchase items and pay for them in instalments over time. This can make e-commerce more accessible to customers with limited financial resources. They have over 10% of shares in 2023, and we believe that it will become one of the popular payment methods in the coming years. We would highly recommend you implement it in your website.

Factors to consider while choosing the right payment gateway

Below are some of the most critical points you must consider while evaluating different payment gateways providers for your e-commerce site

Safety & Reliability

Safety and reliability are the most important factor to consider when choosing a payment gateway for an eCommerce store. The payment gateway should use the latest security technologies to protect customers’ financial data. It should also be PCI compliant, which means that it meets the security standards set by the Payment Card Industry Security Standards Council. Here are some of the security features that you should look for in a payment gateway:

- Secure Sockets Layer (SSL) encryption: SSL encryption protects customer data from being intercepted by unauthorized individuals.

- Tokenization: Tokenization replaces sensitive customer data, such as credit card numbers, with unique tokens. These tokens can then be used to process payments without exposing the customer’s actual data.

- Fraud detection: Payment gateways use a variety of fraud detection techniques to identify and prevent fraudulent transactions.

Convenience and Ease of Use for the Users

The payment gateway should be easy for customers to use. It should support a variety of payment methods, including credit cards, debit cards, PayPal, Google Pay as well as the popular payment methods prevailing in your country or country you serve. The checkout process should be simple and straightforward, with minimal steps required. You should look for the following features in the payment gateway

- Support for a variety of payment methods: Customers should be able to choose the payment method that they are most comfortable with.

- Simple checkout process: The checkout process should be as short and easy as possible.

- Mobile compatibility: The payment gateway should be mobile-friendly so that customers can make purchases on their smartphones and tablets.

Cost per Transaction

Payment gateways charge different transaction fees.as a store owner you should evaluate the cost per translation against the feature they are offering, and consider the one that is most cost-effective, this will directly help in increasing your profit margins or reduce the final sale price. Every payment processor has different pricing models, some common charges include translation fees and subscription fees per month.

Cost of Integration

The cost of integrating a payment gateway with an eCommerce platform can vary. Some payment gateways offer free plugins for popular eCommerce platforms like Magento, Shopify or WooCommerce which can be configured without a lot of technical expertise. Others provide only the APIs, for which you will need an experienced developer to integrate it into your website or ecommerce store.

Our picks for best payment getaways for an eCommerce website in 2023:

PayPal/Braintree

It is one of the most popular payment gateways in the world, with over 446 million active accounts. PayPal is a very safe and reliable payment gateway. It uses the latest security technologies to protect customer data and prevent fraud. It is also very easy to integrate into your Magento store, as most popular e-commerce platforms like Shopify, Magento, WordPress have a plugin available. PayPal is very easy to integrate with any e-commerce platform. Though it is not the most feature rich and customizable platform, after merging with Braintree.

PayPal does not charge a monthly fee. However, it does charge a transaction fee for each payment. The transaction fee varies depending on the payment method used and the country where the payment is made, for credit and debit card payments in the United States is 2.9% + $0.30.

PayPal Braintree supports recurring payments.

Available Payment Methods:

- PayPal

- Venmo

- Credit Cards – Visa, Mastercard, American

- Express, Discover, Diners Club, JCB

- Debit Cards – Visa Debit, Mastercard Debit, Maestro

- Bank transfers,

- Google Pay

- Apple Pay

Some Popular Local Payment Options:

- KakaoPay, Naver Pay in Korea

- iDEAL, Postpay in Europe

- Alipay, WeChat Pay in China

- UPI in India

- Boleto Bancário in Brazil

- SPEI for Maxico

- Mir for Russia

Stripe

Stripe is a very reliable payment gateway provider that allows businesses to accept credit and debit card payments, and most other forms of payment online. It is known for its ease of use and its powerful features. The payment option and the transaction fees for stripe are almost similar to that of PayPal. But Stripe integrates with the e-commerce store better, and it is more customizable compared to Paypal. Stripe is also much better with advanced features like auto-payment or recurring payments.

Strips supports advanced payment methods like BNPL (Buy Now Pay Later), Recurring Payments.

Available Payment Methods:

- Credit Cards – Visa, Mastercard, American Express, Discover,

- Debit Cards – Visa Debit, Mastercard Debit

- bank transfers,

- Google Pay

- Apple Pay

Some Popular Local Payment Options:

- Alipay, WeChat Pay in China

- Paytm, UPI in India

- Boleto Bancário in Brazil

- SPEI for Maxico

- Mir for Russia

- KakaoPay, Naver Pay in Korea

AmazonPay

Amazon Pay is a great option for any e-commerce store, it is very easy to integrate and comes with almost similar features compared to PayPal. It is the same gateway that is used in Amazon.com and many other amazon platforms, so you can be assured of its reliability and safety. It is comparatively new, but still offers most payment options, with an added advantage of allowing Amazon Pay Balance and Amazon Gift Cards.

AmazonPay also supports recurring payments.

Available Payment Methods:

- Credit Cards – Visa, Mastercard, American Express, Discover, JCB

- Debit Cards – Visa Debit, Mastercard Debit

- Amazon Gift Cards/Amazon Prime

Some Popular Local Payment Options:

- KakaoPay, Naver Pay in Korea\

- iDEAL, Postpay in Europe

- Alipay, WeChat Pay in China

- Paytm, UPI in India

- Boleto Bancário in Brazil

All the above payment gateways are free to integrate, and do not have any monthly subscription or licensing fees, though they charge transaction fees which differ from country to country, and payment methods used. And we believe they provide the best balance of features, reliability, ease of integration as well as cost. If you are not sure, you can choose any of the three and it will work flawlessly with your e-commerce store. All of them seamlessly integrate in most e-commerce platforms like Magento 2, Shopify, WooCommerce, Shopware, BigCommerce, and more.

Our recommended platform for individual e-commerce platform

Autorize.net

Authorize.net is a old and reliable payment gateway provider, unlike the above three options they do charge a monthly fee of $25 for using the services, and it charges $2.9 + 30 Cents per transaction. However, if you already have the membership with Authroize.net the transaction fees will be flat 10 Cents per transaction.

Klarna

Klarna is another great payment gateway provider which is gaining lot of popularity in recent times. It is best when it comes to flexible payment options, it offers a wide range of BNPL options, with many interests free easy EMI. It is especially suitable for the site with high value products like jewelry, consumer electronics, industrial machineries, etc. It is very popular in the European countries, and it can be easily can be integrated into any modern e-commerce platform.

WordPlay

WordPlay is a very popular payment option for more large-scale enterprises, it offers best in class security, great customer support and best of all the support for omni-channel payment. WorldPay supports payments across various channels, including in-store, online, and mobile.

Bambora

Like WordPlay, Bambora is also a popular choice among large-scale enterprise users. Bamboar is particularly popular for its reliability and customer-support. They provide a dedicated account manager and 24/7 support with almost 0 downtime.

2Checkout

Another reliable and widely accessible payment gateway provider, 2Checkout is available in over 100 countries and supports over 150 currencies. It comes with almost all the payment options, and it also supports recurring payments, subscription and membership.

Our recommended platform for individual e-commerce platform

Best Payment gateway for Magento 2

We would recommend using Stripe for your Magento 2 store. Magento 2 is a very customizable platform and offers a variety of customization options, so stripe allows you to use the potential of Magento and create a highly customized and tailored checkout and payment experience as per your requirements. And even if you don’t need a lot of customization, in our experience we find Stripe to be very reliable and it integrates very seamlessly with Magento 2. If for any reason Stripe is not suitable for you, then you can go with Braintree which integrates really well with Magento 2 offer similar options, fees, but has little less customization.

Best Payment gateway for WooCommerce

We would recommend PayPal for WooCommerce. It is very easy to integrate and configure PayPal in a WooCommerce/WordPress store. You can find PayPal plugin developed by WooCommerce team for WordPress Store and get it working in less than 10 minutes. And we find PayPal to work reliably with WordPress.

Best Payment gatway for shopify

If you are using Shopify then you don’t need to install to integrate any 3rd party payment providers, Shopify Payments is simply the best. It is directly baked into Shopify platform, and it is one of the best payment gateways across all the e-commerce platforms. It offers reliable performance and all the payment options your any customer will ever need. It is incredibly quick and easy to set up. However, transaction fees are slightly on a higher side, but the difference is not huge unless your margins are very low, or the scale of business is huge.

If you need any help with payment gateway integration or payment or checkout customization

Would you like to share this article?

All Categories

Latest Post

- The Rebalance Spiral: Debugging Cooperative Sticky Assigner Livelocks in Kafka Consumer Groups

- The Propagation Penalty: Bypassing React Context Re-renders via useSyncExternalStore

- The Memory Leak in the Loop: Optimizing Custom State Reducers in LangGraph

- The Reservation Tax : Mitigating MSI Latency in High-Velocity Magento Checkouts

- Mitigating Crawl Budget Bleed: Detecting Faceted Navigation Traps via Python Generators